Pennsylvania

Elderly living and senior care assistance in the state of Pennsylvania is strongly distinguisheded by dependence on the state Medicaid program. In 2007 alone, Medicaid paid out over 15 billion dollars for PA long term care services. In an attempt to relieve the ample cost burden, state officials announced a Pennsylvania long term care partnership program to counter state spending with the ever intensifying demand for PA long term care.

There are four defining components of the Pennsylvania long term care partnership program that insurance carriers must present in order to sell partnership insurance plans. The first is inflation protection, which is meant to protect policy holders from raising premiums as the expenditure of PA long term care progressively climbs. The second feature is dollar for dollar asset protection, wherein the policy holder assets and the benefits they are given are equal counterparts. The third attribute is that Pennsylvania long term care partnership policies must be tax qualified, which permits the policy holder to deduct a portion of the premium paid out from their tax statement. Last but not least is the comprehensive coverage component, which offers many different types of care. Comprehensive coverage includes 24/7 aid, daily or intermediate assistance, custodial care (i.e. personal needs), or home care.

Senior citizens in Pennsylvania encompass approx. 15 % of the state's overall population. More than 80 % of these senior citizens live in metropolitan cities and surrounding regions.

Pennsylvania long term care brokers and counselors are readily available to meet you in all areas of the state such as Philadelphia, PA and Pittsburgh, PA

Contact:

Missouri

When it comes to elderly care and elderly living in the state of Missouri, most turn to nursing home facilities for their extended needs. Cost trends for nursing homes in Missouri often tend to reflect the national trend of a steady yearly increase. However, when it comes to assisted living, cost trends have actually displayed a steady decrease in yearly expense.

Without Missouri long term care, care giving families and the person in need pay out of pocket for needs based care programs. However, the current frailty of the US economy has made the ability to self insure less and less likely for a substantial number of senior citizens. Paying out of pocket and in due course emptying retirement accounts is far too typical in MO

. Medicaid certification in the state of Missouri requires that an individual has less than $ 1000 in assets. Many seek Medicaid backing but do not meet the asset qualifications. For this reason, Missouri put into effect their partnership program. In an effort to supply top notch insurance coverage for all MO long term care needs, the Missouri partnership provides both asset disregard and dollar for dollar safeguards. With these two defining benefits, policy holders are able to protect their assets and employ every last dollar of their policy minus heavy implications on Medicaid. Medicaid is not guaranteed. However, the Missouri long term care partnership program allows the insured to apply for Medicaid at any time during the life of the policy.

To meet the obligations of a MO long term care partnership policy, the policy itself must offer inflation protection and be tax qualified. These two features both protect the policy holder against increasing premiums and warrant tax free benefits.

14 % of the population in Missouri is senior citizens.

Missouri long term care service and salespersons are readily available in all vicinities of the state including Kansas City, MO and St. Louis, MO

Contact:

OHIO

While the annual expense for Ohio long term care is less than the US average, it is still a substantial bill that caregivers and their aging loved ones need to address. Semi private nursing home rooms tend to require anywhere between $ 60,000 and $ 70,000 a year while a private one bedroom nursing home can cost as high as $ 75,000 on an annual basis. In addition, home health aides and assisted living in most cases cost around $ 40,000 to $ 50,000 per year.

The Ohio Partnership for Long Term Care insurance program responds to these cost trends by furnishing an insurance option to help OH long term care families finance such extraneous rates. The first feature of the partnership program is inflation protection. The caterings of inflation protection include a mandatory 3 % minimum inflation benefit for policy holders younger than 76 years of age. The second feature is convenience of access to Medicaid, allowing for policy holders to inquire for Medicaid even if their benefits have yet to be diminished. The third feature is a reciprocity agreement, which allows for partnership policies purchased in one state to be made use of in another.

The fourth feature that Ohio long term care offers is unique to OH LTC services. The state of Ohio's partnership program offers Medicaid Asset Protection, which is an outlet for dollar to dollar asset protection. Meaning that if you have a fixed amount of benefit funding, it won't be affected by Medicaid application.

Senior citizens in Ohio encompass 14 % of the total population

Find Ohio long term care agents and representatives in Cincinatti, OH and Columbus, OH

Contact

VirginiaThe partnership program for Virginia long term care was applied in September of 2007 as a means to support baby boomers in or nearing the age of retirement to shield their accumulated assets. However, while parternship and non partnership insurance options are related in many areas, not all VA long term care policies are certified partnership policies. The biggest discrepancy between the two is that partnership policies offer dollar for dollar asset protection. With dollar for dollar asset protection in the state of Virginia, the amount that a VA long term care policy disperses is equal to the quantity that is safeguarded when inquiring for an individual's Medicaid elibility. For example, if your policy covers up to $ 75,000 in benefits, the policy holder ascertains that same $ 75,000 and can still incorporate Medicaid if needed. Medicaid support is typically used when the assets from a VA long term care policy are maxed out. The conditions for Medicaid, which are determined on an individual basis, consist of but are not limited to: - Verification of residency in the state of Virginia

- Proof of income and resources

- Social security information

- Completion of Medicaid documentation

Inflation security is also a defining component of any partnership insurance policy. Inflation protection is installed in partnership policies as a response to the yearly cost increase for Virginia long term care. Virginia long term care policy holders who are under the age of 61 must have full inflation safeguards. Policy holders aged 61-76 are required to carry a pre-determined level of inflation protection. Those aged 77 or older are highly encouraged to have inflation protection, although it is up to their own choosing. Senior citizens in Virginia take up more than 12% of the total population. Virginia long term care salespersons and brokers can be found in all areas of VA, including Richmond, VA Virginia Beach, VA Connect with:

Washington The expense of home health aide in Washington State is far more than the national norm. Annual spendings of such services often times cost more than six figures and have been recorded upwards of $ 175,000 per year. Typical nursing facility expenditures in WA are between $ 75,000 and $ 85,000. Comparatively, assisted living services commonly carry a $ 35,000 to $ 45,000 annual bill. These reports, made public from Genworth Financials yearly Cost of Care Survey, combine to make Washington the 3rd most expensive area for needs based programs. But this inflated cost has by no means gone unrecognized. Legislators in WA are currently investigating a proposed Partnership Program for Washington long term care as a means for asset safeguard during an individual's funding of long term care. The rules of this partnership program, which must be adopted by the Washington State Insurance Commissioner, will encompass the following. - Plans for prospective applicants age 79 or younger must provide assured protection from inflation upon the time that the policy is acquired by the buyer.

- Any sort of confinement, whether in a hospital or nursing home facility, shall not be a requirement for policies

- Those in community based or home care have an optional insurance coverage benefit

- Policies must have an ensured renewability provision

Key to Washington State's regulations for elderly care services is a focus on community and home care services. Since the turn of the new millennium, the vast majority of spending (79 %) for Washington long term care services has been on home care, compared to nursing home facilities that only encompass 21 %. This trend has had a considerably positive outcome for the elderly care budget and has made long term care in WA a more viable option. More than 12 % of the total population in Washington is senior citizens. Find Washington long term care agents in the greater Seattle area. Contact

Texas Like plenty of other states, Texas utilizes a partnership program for long term care insurance companies and the one's they serve. The Texas Partnership for Long Term Care program was applied as a means of spreading awareness about how vital long term care preparation is in TX. The accouterments of the Texas Long Term Care Partnership program are carried out by various subdivisions of Texas government. First, The Texas Health and Human Services Commission handle Medicaid eligibility for each specific case. Second, the Texas Department of Aging and Disability Services ascertain estate recovery for asset disregard. All insurance carriers who offer TX long term care insurance partnership coverage must meet the requirements laid down by the Texas Department of Insurance. The three major conditions are as follows - Protection against inflation: Policy holders between the ages of 61 and 76 must purchase inflation protection from the compound annual inflation rate of 5 %. Policy holders younger than 61 and older than 76 have the choice to carry inflation protection

- Options for tax qualified protocols: if a policy is tax qualified, then the holder can write off part of the policy premium.

- Disclosure statement: All Texas long term care policies must contain full disclosure that the policy the person has acquired is a certified partnership policy.

When it comes to funding health aides in the home, Texas families and the individual (s) who are in need of care generally initiate funding out of pocket. However, the average cost of in home care in Texas is ordinarily between $ 35,000 and $ 45,000 per year. This annual price, which grows on a yearly basis, exhausts many personal retirement savings accounts. Subsequently, an usual trend for TX long term care is to pay out of pocket for as long as possible and then enlist the aid of government funding. The senior citizen population takes up about 10 % of Texas's total population. Find Texas Long Term Care agents in all major cities and surrounding areas. Contact

New York

The predicted fee of a nursing home in New York is extensively higher than the national annual average of about $ 67,000. If a person in need of care resorts to a private room in an NY nursing facility, they can anticipate to pay upwards of $ 100,000 per year. However, the state of New York's partnership program for NY long term care has been in place for a substantial amount of time and has helped numerous senior citizens in New York.

Those who obtain insurance plans with partnership clauses reap the benefits of an assortment of different partnership criteria. The NY partnership program for long term care was essentially put in place as a means of helping senior citizens furnish the health of their assets and resources and apply for Medicaid. The partnership program extends basic Medicaid coverage in two particular ways. The first is a Total Asset Protection plan, whereby policy holders deemed eligible can shield their assets entirely. The second is a dollar for dollar asset protection program.

Many other states have designed their partnership programs after New York's. The partnership policies require all those that sell them benefits pertaining to varying levels of care and protection against inflation to name a few. Within the partnership program, however, is an unique offer that many other states with similar programs do not feature. The Partnership Independent Assessment Benefit is a policy benefit that helps those who were refused benefits by their partnership insurance provider. This component allows those who were denied benefits owing to their failure to meet disability provisions to appeal their case to the NY State Partnership office.

The populace of New York is highly influenced by the senior citizen residents, which takes up approx 13.5 %.

Find New York state long term care representatives

Contact

Minnesota Minnesota provides its own concentrated version of Medicaid dubbed the Minnesota Medical Assistance Program. Like Medicaid, this program aids those whose assets qualify with financing for MN long term care. Like many other states, Minnesota's state insurance commission has a partnership program with private insurance companies. The program carries distinct obligations on part of the policy holder and the carrier relatively. The necessities are as follows. Policy holder requirements- Applicant must be deemed tax qualified according to Internal Revenue Code's Section 7702B (b)

- Completion of consumer protection requirements as illustrated by the 2005 Minnesota Deficit Reduction Act

- Consequent to the initiation of coverage, policy holder must be a registered native of the state of Minnesota

- Must carry inflation protection until the age of 76

Insurance Provider Policy Requirements- Must provide coverage of nursing home or in home care for a minimum of one year

- Coverage for Alzheimer's if policy is implemented prior to diagnosis

- Options for protection against inflation

- Present policy holder with coverage analysis, noting constraints and benefits

- Policies may only be revoked if payment of premiums are delinquent (renewability guarantee)

- Contractual agreement with policy holder that policy can be terminated within the first 30 days of its initiation

Minnesota long term care consumers and/or current policy holders are entitled to free publications from the Minnesota Department of Commerce with necessary MN long term care current important information. Senior citizens in MN take up roughly 13 % of the state's overall population Find Minnesota Long Term Care agents near youContact

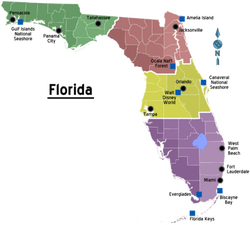

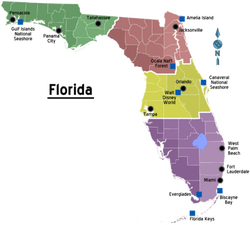

Florida

Florida, which is the senior citizen capital of the United States, is highly characterized by the rapid rise in price for long term care. These heightening rates are highly associated with the rise in inflation. The annual cost of a private room in a nursing home regularly goes beyond $ 80,000 a yr. In addition, a semi-private room isn't much cheaper either, as they oftentimes yield a $ 75,000 annual fee.

Florida's long term care partnership policy program was first created more than 30 years ago. Even so, it wasn't until 2005 when Florida legislation passed a bill fully announcing the partnership program. FL long term care insurance policy holders reap the benefits of preserving their assets with Florida's dollar to dollar matching program. For example, if a Florida homeowner buys a $ 40,000 insurance policy, the insurance carrier will cover up to $ 40,000 in long term care costs at the time services are needed. Additionally, partnership policies in Florida obligate the carrier to furnish a minimum of one type of lower level care such as adult day care or home health care.

There are two separate ways in which FL long term care plans cover costs. The first is to pay for a daily benefit sum, or the actual expenses of each day. The second is to pay the policy holder an indemnity, which is a set dollar amount dispersed on each day of coverage.

The minimum prerequisites for a FL long term care policies participation in the partnership program are a means for protecting the policy holder completely. The policies must carry inflation coverage, be tax deductible, and be fully disclosed to the individual. Unique to Florida long term care is the state partnership reciprocity program. In essence, this program allows for partnership policies to be used in different states and vice versa. This agreement, however, is contingent upon the other states approval of the reciprocity agreement with the state of Florida.

Florida leads the nation in senior citizen population, encompassing a vast 17 % of the total population

Find Florida Long Term Care agents in

California

Legislative incentives in California demand that an annual consumer rate guidebook for CA long term care insurance be created by the state insurance commissioner. Brokers in California are required to give current and prospective policy holders a copy of the state issued "Taking Care of Tomorrow" pamphlet. This pamphlet is prepared by the California Department of Aging and is a means of educating potential policy holders on the different issues of long term care insurance coverage.

California nursing home rates reflect the national norm of an annual 5 % increase in price. For example, if a California long term care bill is $ 60,000 in 2012, it will reach about $ 75,000 a year by 2017. This correlates to an average increase of $ 3,000 each year that the care is needed.

In California, long term care insurance brokers can sell one of three different plans of protection. They are nursing and residential care facilities only, in home care only, and comprehensive long term care. The thorough option for California long term care covers care in home and in a facility. Policies in the comprehensive CA long term care option must present a minimum of eight distinct benefits. Compared to other states, California has a low populace of senior citizens, assessed at about 11 % of the total number of people. However, California also has the largest total populace out of all fifty states. California long term care insurance agents are available to meet you in all major California cities and regions.

Contact

|

RSS Feed

RSS Feed